The Roll Industry in 2024: A Year of Steady Growth and Global Expansion

The 2025 Annual Meeting of the Roll Branch under the China Foundry Association recently offered a thorough overview of the roll industry’s 2024 performance. By analyzing the meeting’s data and benchmarking it against historical figures, we can uncover key growth patterns and future opportunities for this critical manufacturing sector.

Sales Volume and Market Scale: Consistent Expansion

2024 marked a notable milestone, with national roll sales hitting 1.018 million tons and revenue reaching 17.208 billion yuan. This builds on 2023’s 15.8-billion-yuan market size—signaling steady growth. Experts project the market will exceed 18 billion yuan by 2025 if trends hold.

While 2021–2022 sales revenue topped 38 billion yuan (with minor statistical scope differences), the long-term upward trend is clear. This growth reflects rising demand across downstream sectors like steel and heavy machinery, cementing the industry’s role in industrial supply chains.

Export Performance: Strengthening Global Footing

2024 exports stood out: 232,000 tons shipped, generating 4.655 billion yuan—roughly 50% higher than 2019. These underscores growing international trust in Chinese roll quality.

In 2023, exports reached 273,000 tons (15.6% year-on-year growth), with ASEAN driving 34.7% of that increase and accounting for 38.2% of total export value. Though 2024 volume dipped slightly, the broader upward trend remains. Notably, exports’ share of total output rose from 15% (2018) to 28% (2023), making global sales an increasingly vital growth driver.

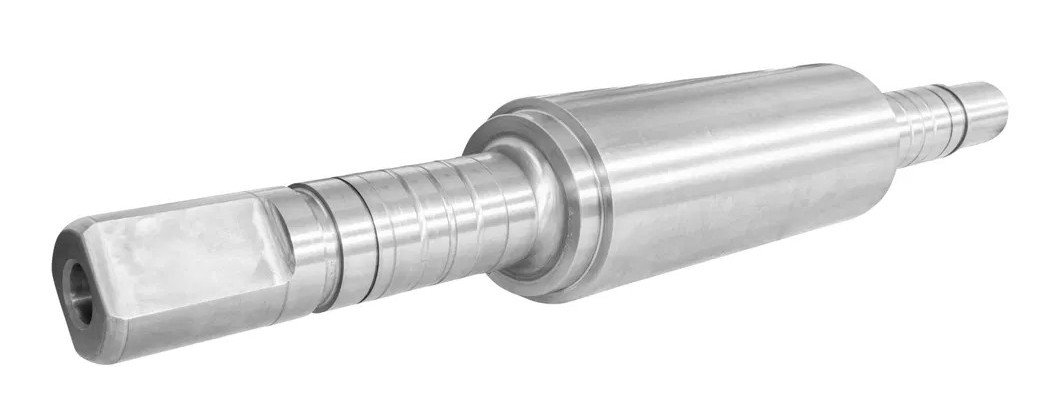

Explore Tailored Roll Solutions on Our Platform

As the roll industry expands globally, sourcing quality products is key. Our platform offers diverse rolls, all products meet strict quality standards, providing both standard and customized options. Explore our lineup to find solutions for your business growth.

Conclusion: Promising Outlook with Key Focus Areas

2024 brought tangible growth for the roll industry, fueled by domestic and global demand. While challenges like sustaining global competitiveness persist, the sector is well-positioned for 2025. For manufacturers, leveraging domestic momentum and deepening penetration in markets like ASEAN will be key to long-term success—supported by the right product partnerships.

Post time: Aug-28-2025